Prusik Investment Management LLP Annual Best Execution Disclosure 2020

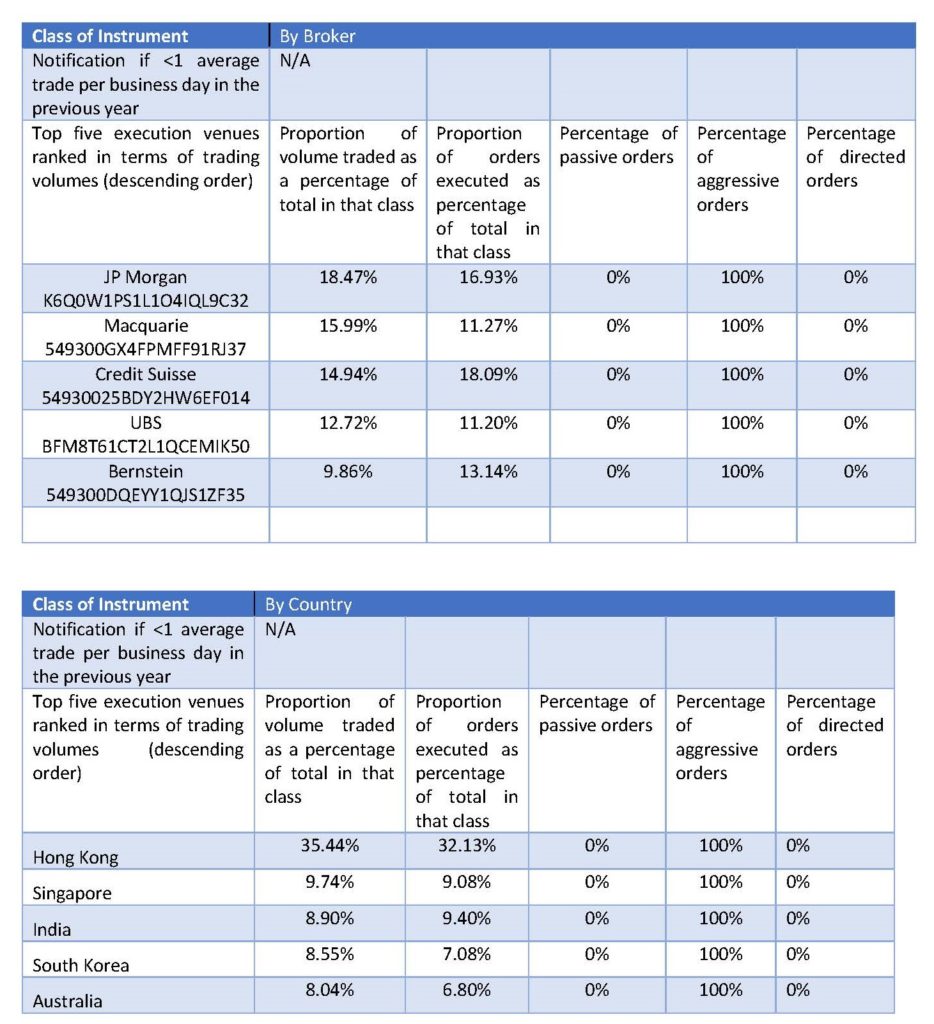

On an annual basis Prusik Investment Management LLP (“Prusik” or the “Firm”) is required to provide additional disclosures around the execution venues utilised for each asset class and certain information on the quality of execution in line with the requirements of Regulatory Technical Standard 28 of the MiFID II regulation.

The Firm takes into consideration various execution factors, which are detailed within its best execution policy, when placing an order. The Firm takes into account each client’s objectives, the specific financial instruments to which the order relates, the execution venues or counterparties available for such orders and the prevailing market conditions.

The Firm has categorised all its clients as professional under Article 4 (1)(11) of Directive 2004/39/EC. However, it is noted that the Firm has been delegated the portfolio management function of UCITS funds and therefore may have exposure to underlying retail clients.

During the period January 2020 to December 2020, the Firm confirms that there were no material close links, common ownership or conflicts of interest between us and the execution venues / brokers used by the Firm.

Prusik places orders to be executed with approved counterparties. The list of approved counterparties is reviewed regularly and may change over time. Amendments to the approved counterparties list will be made taking into account a number of factors including; the credit worthiness of the counterparty and the execution performance of the counterparty. The Firm does not receive payments, discounts, rebates or non-monetary benefits in its trading arrangements.

There is no preferential treatment across clients in relation to execution and/or allocation arrangements, with the exception of where venues are dictated by the client.

A governing body meeting is held on a quarterly basis in order to review adherence to the best execution policy. It is attended by senior management, compliance and risk who review the management information available for all traded instrument types and discuss any concerns or issues.

During the year ending December 2020, the Firm has met its obligation to achieve the best possible results for its clients on a consistent basis.